TLS and SET

Issues of Transactions Security:

- Problems of remoteness

- Trust factor between parties

- Use of sensitive data

- Atomicity of transaction

- Internet protocol problems

- Authentication

- Confidentiality

- Transparence and critical mass problem

Two valiant protocols fought against the darkness:

-

HTTP over SSL (Secure Socket Layer), or HTTPS

- Communication confidentiality and integrity

- Mutual authentication

- No guarantees on data usage

- No strict authentication of client (in practice)

-

SET (Secure Electronic Transaction)

- Guarantees on data usage and transaction security enforcement

- Missing critical mass support

TLS (Transport Layer Security)

Transport Layer Security (TLS) is the successor protocol to SSL. TLS is an improved version of SSL. It works in much the same way as the SSL, using encryption to protect the transfer of data and information.

TLS enforces:

- Confidentiality and integrity of the communications

- Server authentication

- Client authentication (optionally)

TLS designed to be flexible with respect to technical evolution. Clients and servers may use different suites of algorithms for different functions

- key exchange algorithm

- bulk encryption algorithm

- message authentication code algorithm

- pseudorandom function

During handshake, cipher suites are compared to agree on shared algorithms in order of preference.

Is TLS resistant to MITM?

What could the MITM do?

- Let the original certificate through? No, because it needs to actually have the key on that cert.

- Send a fake certificate (i.e. signed by a non-trusted CA)? No, it will be rejected by the client

- Send a good certificate with a fake name? No, it will be rejected by the client

- Send a good certificate but substitute the public key (making it invalid)? No, it will be rejected by the client

TLS is by design resistant to MITM.

Cons of TLS

- No protection before or after transmission

- On server

- On client (e.g., trojan)

- By abuser (e.g., non-honest merchant)

- Relies on PKI: depend on the security and trust of the root and intermediate CAs

- Not foolproof

Overcoming TLS/PKI limitations

HSTS (HTTP Strict Transport Security)

- HTTP header to tell the browser to always connect to that domain using HTTPS

- Browsers (e.g., Chrome) implement a HSTS preload list: some websites are simply never loaded over plain HTTP

- Defends against SSL stripping

HPKP (HTTP Public Key Pinning)

- HTTP header to tell the browser to “pin” a specific certificate or a specific CA

- Browser will refuse certificates from different CAs for that origin

- Defends against trust cert mis-issuance

- Deprecated

Certificate Transparency

- CA submit the metadata of every issued certificate to a (independent, replicated) log

- Can be enforced by browsers

- browsers refuse certs not logged in CA logs

- Defends against certificate misissuance: site owner can check \ be notified of certificates issued for the properties they manage

- You can look at the CT logs: https://crt.sh

SET

SET was a joint effort VISA+MasterCard consortium with the goal to protect transactions, not connections.

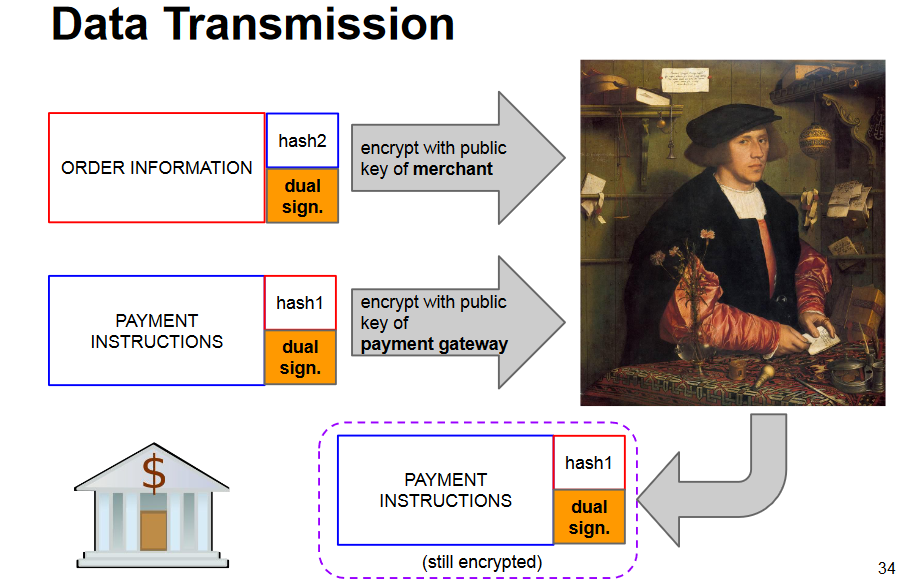

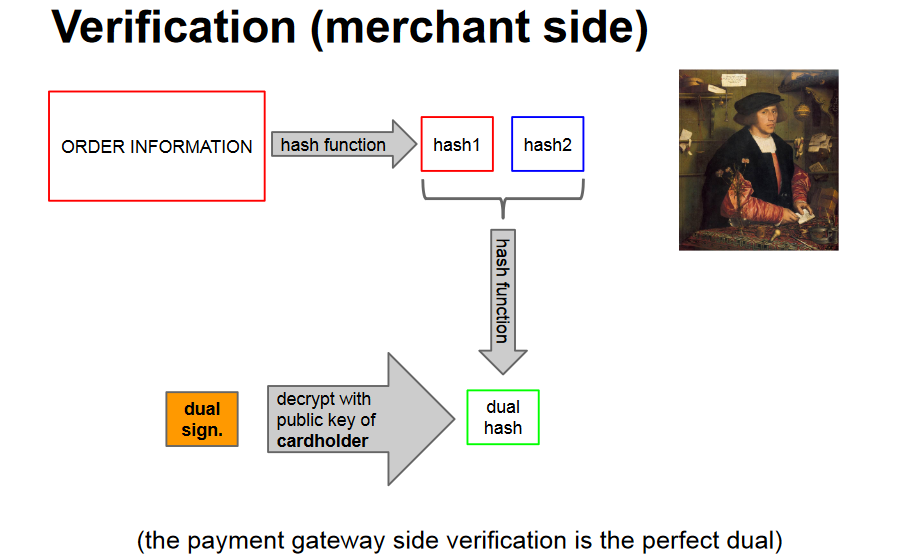

Approach:

- Cardholder sends the merchant only the order of goods

- Send the payment data to the payment gateway

- Empower gateway to verify correspondence

Uses the concept of a dual signature: a signature that joins together the two pieces of a message, directed to two distinct recipients

The failure of SET

SET requires a digital certificate from:

- Merchant

- Payment Gateway

- Cardholder: impossible to scale!

Therefore, a pre-registration of the cardholder is needed! (won't buy that book)

Nowadays a simple redirect with a token to the website of the bank is commonly used

No Comments