Earned Value Analysis

- Budget at completion ($BAC$): total budget for the project

- Planned value ($PV$): budgeted cost of work planned

- Earned value ($EV$): budgeted cost of work performed

- Actual cost ($AC$): actual cost for the completed work

Schedule

The project running behind schedule if the value produced is less than the value planned ($EV < PV$).

- Schedule variance: $SV = EV – PV$

- Schedule performance index: $SPI = EV /PV$

Both values are lower than zero if the project is running behind schedule.

Cost

The project running over budget if the value produced is less than the cost ($EV < AC$).

- Cost variance: $CV = EV – AC$

- Cost performance index: $CPI = EV/AC$

Both values are lower than zero if the project is spending more than planned.

Estimations

Perform an estimation of the budget at completion of the project using some assumptions:

- continue to spend at the same rate (same CPI)

- continue to spend at the baseline rate

- continue at the same cost and schedule performance index (same CPI and SPI)

For example the cost estimate at completion can be:

- If we continue to spend at the same rate $EAC = BAC/CPI$

- If we continue to spend at the original rate $EAC = AC + (BAC – EV)$

- Both CPI and SPI influence the remaining work: $EAC = \frac{AC + (BAC – EV)}{(CPI \times SPI)}$

Past exams exercises

2020 09 04 Q3 (3 points)

A project has been setup to build an application composed by four software components. The budget assigned to the project is 14000 euros. The project costs are the following:

- 2000 euros for the initiating phase.

- 1000 euros for the planning phase.

- 9000 euros for the executing phase: 2000 euros for the first component, 3000 for the second, 2000 for the third, 2000 for the last.

- 2000 euros for the project closing.

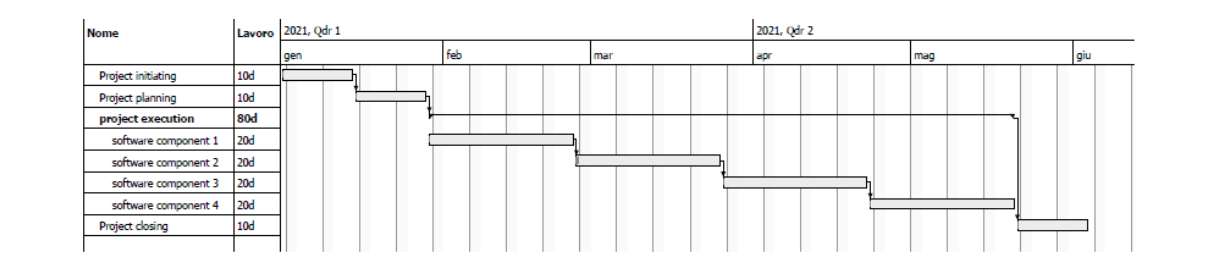

The schedule is the following:

A planned review is provided after 60 days from the project start; the project manager calculates the following parameters according to the Earned Value Analysis:

- Earned Value is 7500 euros.

- Actual Cost is 6000 euros.

As PM of the project please answer the following questions:

- Inform the stakeholders about the situation of the project in terms of schedule and cost.

- Estimate the budget at completion ($EAC$) of the project considering the following two options:

- Continue to spend at the actual rate.

- Continue to spend at the original rate.

SOLUTION

From the project definition:

- $BAC = 14000$

- $PV = 8000$ (after 60 days we should have completed the software component 2)

- We are using less budget than planned since the value produced is greater than the cost $EV > AC$ ($7500 > 6000$) but we are behind in schedule since the value produced is less than the value planned $EV < PV$ ($7500 < 8000$).

- The cost performance index of the running project is $CPI = EV/AC = 1.25$.

- Using the actual rate $EAC = BAC/CPI = 14000/1.25 = 11200 €$

- Continuing at the original rate $EAC = AC + (BAC – EV) = 6000 + (14000-7500) = 12500 €$

2019 02 01 Q3 (3 Points)

A project has been set up to build an application composed of three software components. The budget assigned to the project is 10000 euros. At a planned review the project manager (PM) calculates the following parameters according to the Earned Value Analysis:

- Earned Value ($EV$) is 800 euros.

- Planned Value ($PV$) is 1500 euros.

- Actual Cost ($AC$) is 1000 euros.

As PM of the project please answer to the following questions:

- Inform the stakeholders about the situation of the project in terms of schedule and cost.

- Estimate the budget at completion ($EAC$) of the project considering the following two options:

- The project will progress spending at the actual rate.

- The project will progress spending at the original rate.

SOLUTION

- The project is running over budget because the value produced is less than the cost ($EV < AC$); in addition, it is running behind schedule because the value produced is less than the value planned ($EV < PV$).

- The cost performance index of the running project is $CPI = EV/AC = 0.8$

- Using the actual rate $EAC = BAC/CPI = 10000/0.8 = 12.500 €$

- Continuing at the original rate $EAC = AC + (BAC – EV) = 1000 + (10000-800) = 10200 €$

No Comments